SUMMARY

The luxury industry entered 2025 amidst its first global slowdown in years, following a 1% contraction of the personal luxury goods market in 2024 to €364 billion. This contraction was primarily driven by a softer macroeconomic backdrop, weaker consumer spending, and the pressure of new U.S. tariff policy.

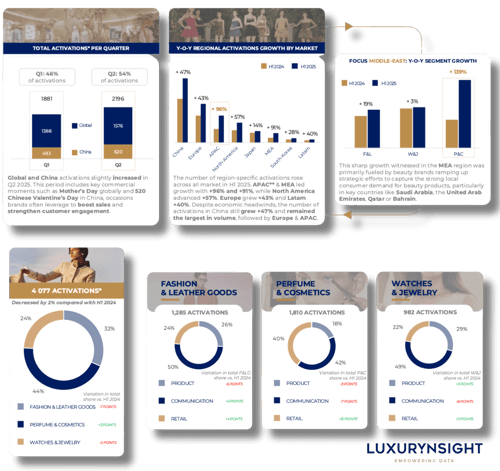

Total brand activations declined by 2% year-over-year (Y-o-Y) in volume during the first half (January to June). This decrease reflects a wider strategic shift for brands, which are increasingly betting on localized initiatives over global activations.

KEY TAKEAWAYS

- Sector Mix Realignment: The Perfume & Cosmetics (P&C) sector witnessed growth, rising to 44% of all brand activity and becoming the top sector by volume. P&C was the sole segment to expand over H1. Conversely, Fashion & Leather Goods (F&LG) and Watches & Jewelry (W&J) contracted, holding 32% and 24% of the sector mix, respectively.

- Retail Momentum: Retail activations surged significantly, increasing by +48% Y-o-Y. This reaffirms the critical role of physical touchpoints in brand strategies. Pop-ups accounted for nearly half of retail activations, while brands utilized mobile concepts (e.g., carts, traveling units) for low-capital, extended reach. Experiential flagships, exemplified by LVMH's "The Louis" in Shanghai, are setting new benchmarks for building loyalty and "heat".

- Regional Growth: Region-specific activations saw growth across all markets. The APAC region recorded the strongest expansion (+96%), closely followed by MEA (+91%), fueled by booming luxury markets in countries like Saudi Arabia and the United Arab Emirates. North America also saw solid gains (+57%). China remained the largest market by volume, with activations climbing +47%.

- Cultural Strategy: Luxury brands expanded their role as cultural producers. In China, exhibitions rose +59%, reframing consumer engagement by offering accessibility through heritage storytelling. Brands are also diversifying into lifestyle territories, blurring lines between categories (e.g., homeware, wellness), as seen during Milan Design Week 2025.

- Pricing and Relevance: The softer macroeconomic environment pushed brands to recalibrate strategies. Average luxury prices rose about +3% globally in H1 2025. Pricing dynamics varied by region and category, with tariffs weighing on F&LG and a strong Swiss franc pressuring W&J. P&C addressed softer consumption by investing more heavily in innovation and personalization.