Annual Global Luxury Brand Analysis Report

2024 was a pivotal year for the luxury industry as the market contracted 2% to €363 billion globally in 2024 — for the first time since the pandemic, materializing a normalization phase after the strong growth of 2022 and 2023 (Bain & Co).

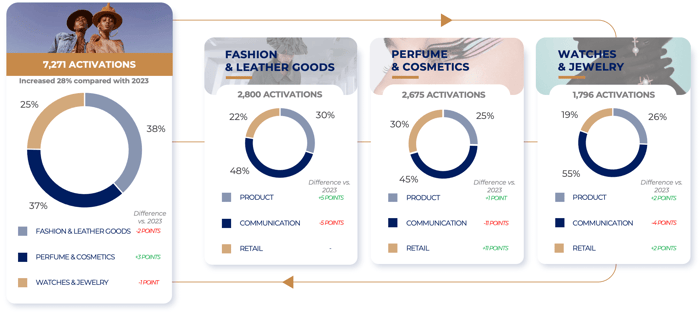

Despite the slowdown, luxury brands maintained their marketing investments, though with notable differences across categories. With Perfume & Cosmetics leading activations, Fashion & Leather Goods stabilizing, and Watches & Jewelry declining by 32%.

Growth efforts focused on APAC and India, while China remained dominant. Brands also expanded into beauty, travel, and wellness, leveraging cultural influence through retail experiences, arts, sports, and hospitality. The Paris 2024 Olympics fueled sports-driven activations, reinforcing luxury’s ties to athletic culture. In 2025, success will hinge on cultural storytelling and innovative engagement.

Explore our comprehensive Annual Global Luxury Brand Analysis Report for more of the in-depth analysis of 2024 market and key predictions for 2025, including consumer trends from Heuritech.

2024 Activations Overview

In 2024, total activations increased by 28% compared to the previous year, signaling heightened global brand engagement. While Fashion & Leather Goods led in activation volume, the Perfume & Cosmetics segment experienced the highest growth in activations. Across all sectors, communication-focused initiatives declined as brands prioritized direct product and retail strategies.

Make smarter brand decisions with

360° monitoring and AI-powered insights!

-1.png?width=1100&height=535&name=Frame%203576%20(1)-1.png)